Employee Provident Fund [EPF] withdrawal on becoming an NRI

My wife joined me in the UK after we got married, leaving behind her job in India. She had some money saved up in an Employee Provident Fund [EPF]. In this article, I'll explain why and how she withdrew her EPF. This article is particularly relevant for Indian citizens who have relocated abroad and are looking to withdraw their EPF. I will not go too much into the details of what EPF is or the various rules that govern it.

Table of contents

- EPF is a retirement savings scheme in India, in addition to the pension

- After three years of no contributions, interest stops accruing (unconfirmed)

- You can withdraw your EPF if you're settling abroad

- TDS may be applicable on withdrawal if you had less than five years of service

- Steps to withdraw the EPF

- 1. Convert your bank account to Non-Resident Ordinary (NRO)

- 2. Check your balance on the EPF Passbook website

- 3. Take note of your contribution summary and interest payments from the EPF Passbook website

- 4. Log into the Unified Member Portal and check the linked bank account

- 5. Update the linked bank account (if necessary)

- 6. Submit a claim form

- 7. You will get an SMS when the claim is settled

- 8. Receive the money in your bank account

- Conclusion

EPF is a retirement savings scheme in India, in addition to the pension

The Employee Provident Fund (EPF) is a retirement savings scheme in India, designed to help employees accumulate funds during their working years. Both employees and employers contribute to the EPF account, typically 12% and 3.67% of the salary respectively, at least as of 2024 when I'm writing this [EPFO: Present rates of contribution].

The government adds interest every year - 8.25% in 2024 [cleartax: EPF Interest Rate 2024]. Over several years, you can build a significant amount of savings in your EPF.

After three years of no contributions, interest stops accruing (unconfirmed)

The FAQs, quoted below, imply that three years after you leave your job in India, the EPF account becomes inoperative and stops earning interest. At that point, you are effectively losing money due to inflation. Therefore, I think it makes sense to withdraw the EPF, ideally within this three-year window.

According to this article on livemint, you could also lose the money to the government after 32 years of not claiming it!

FAQ 44 - How long an employee can continue his EPF membership?

Ans : There is no restriction of period for membership. Even after leaving the establishment a person can continue his membership. However, if no contribution is received into a PF account for 3 consecutive years the account shall not earn any interest after 3 years from the stopping of contribution.

FAQ 141 - What is an Inoperative Account?

Ans : An account is classified as Inoperative account in which contribution has not been received for 3 years after retirement or permanent migration abroad or in case of death. At present, all accounts will earn interest upto 58 years age of a member.

FAQ 142 - Will my inoperative account earn interest?

Ans : No. However, at present, all accounts will earn interest upto 58 years age of a member.

You can withdraw your EPF if you're settling abroad

Fortunately, you can withdraw your EPF if you're settling abroad [The Economic Times].

TDS may be applicable on withdrawal if you had less than five years of service

If you withdraw your EPF before completing five years of service (with one or more employers) and the amount is more than Rs. 50,000 then Tax Deducted at Source [TDS] may apply. In my wife's case, she had worked for more than five years in India, so TDS was not deducted.

Form 15G/15H is a declaration that residents, i.e., not NRIs, can submit to avoid TDS on the interest income if their income is below the basic exemption limit [cleartax: Form 15G, Form 15H to Save TDS on Interest Income].

FAQ 144 - Will my withdrawal be subject to deduction of income tax (TDS)?

Ans : In case a member withdraws his EPF and has rendered less than 5 years of service and accumulated amount is more than Rs. 50,000/, TDS shall be applicable on the following rates:

- Submission of PAN

- If 15G/15H is submitted, no TDS is deducted

- If 15G/15H is not submitted,TDS deducted at 10%

- Non submission of PAN

- TDS is deducted at Maximum Marginal Rate (34.606%)

FAQ 145 - Will tax be deducted at source (TDS) if my service is more than 5 year (60 months)

Ans : No.The service rendered at previous as well as present employer would be added to arrive at total service.

FAQ 146 - What is the benefit of providing PAN?

Ans : If a member provides/link PAN and the PF balance is more than Rs. 50,000/ and service rendered is less than 5 years, then tax (TDS) would be deducted @10% and not at 34.606%.

Steps to withdraw the EPF

1. Convert your bank account to Non-Resident Ordinary (NRO)

I don't know if this is strictly necessary, but we did it just to be safe. NRIs are legally required to convert any regular savings accounts in India to a NRO account. You can read more about this in Tax guide for UK-based NRIs.

Fortunately, we were able to do this online with Federal Bank, but it still took a month of chasing the bank to get it done.

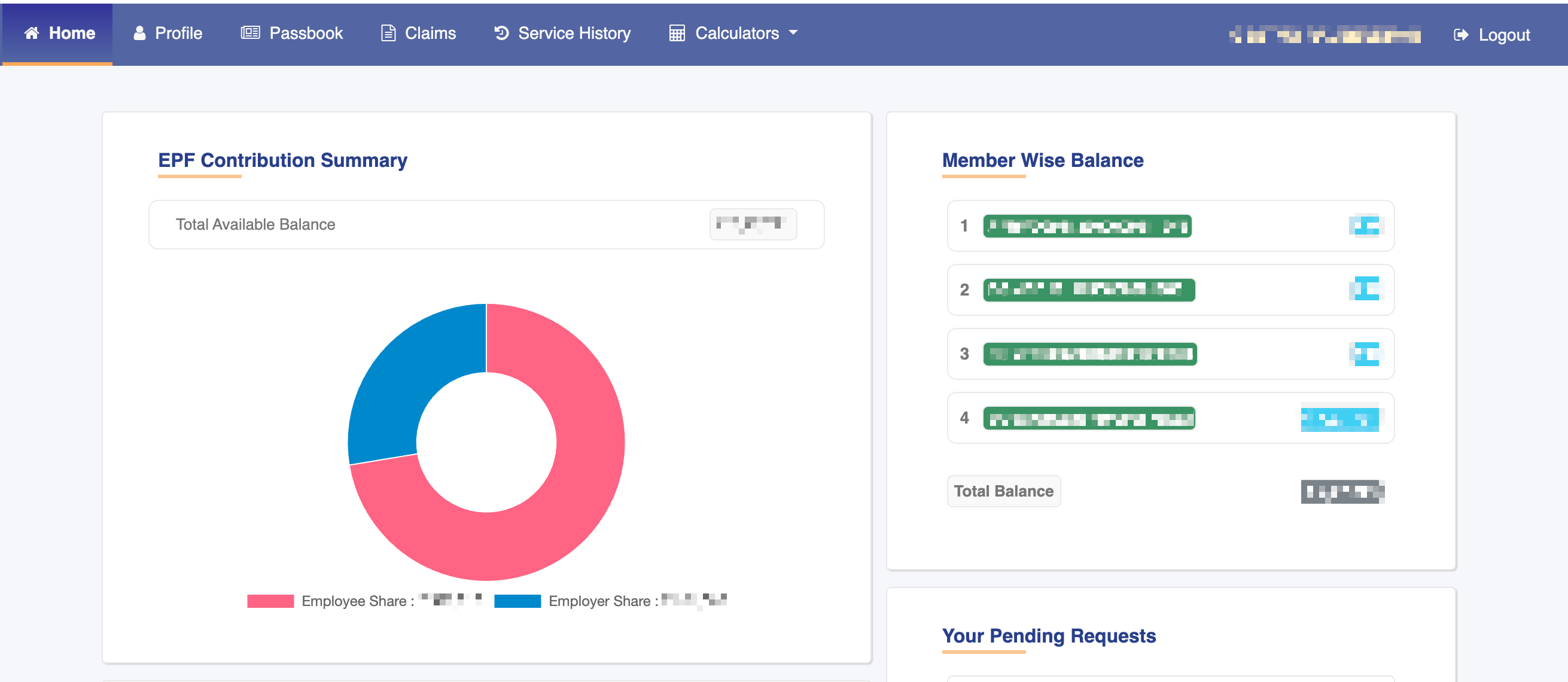

2. Check your balance on the EPF Passbook website

Log into the EPF Passbook website using the same credentials as the Unified Member Portal.

One of the gotchas we ran into here was that if you reset the password on the Unified Member Portal, it could take six hours for the new password to work on the EPF Passbook website! It took us a while to figure this out. The website also keeps logging you out, so you may have to log in multiple times which can get annoying.

Once logged in, check your balance and note the amount you intend to withdraw.

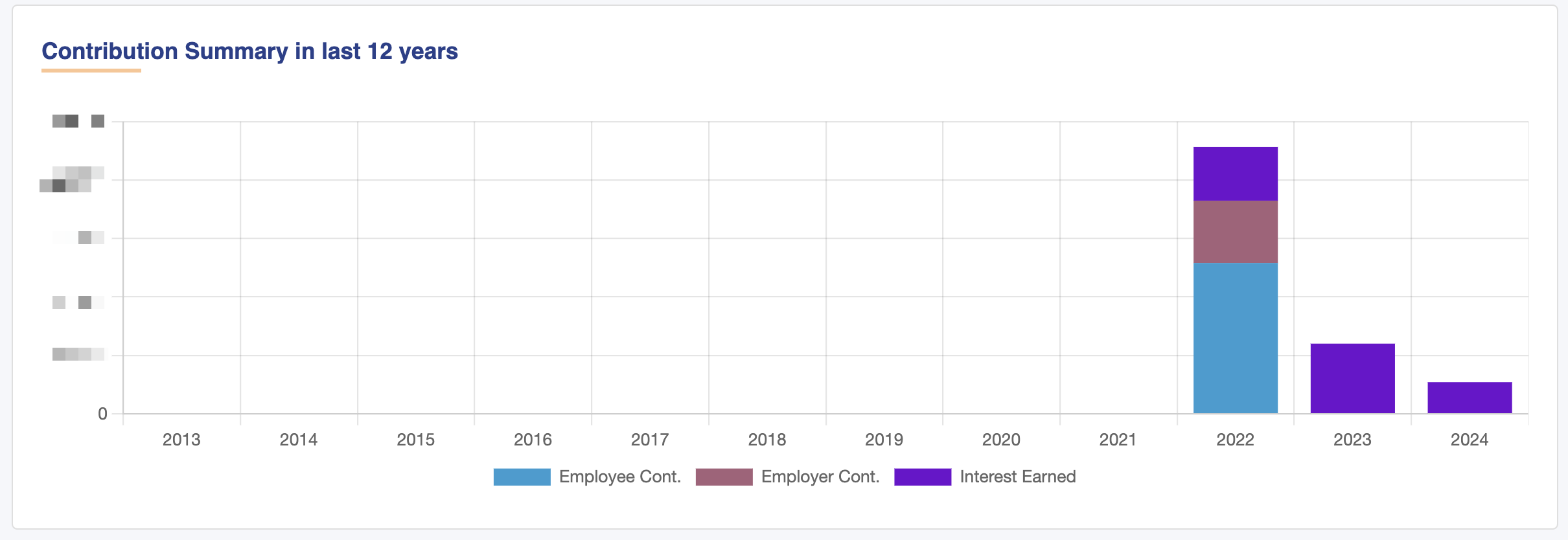

3. Take note of your contribution summary and interest payments from the EPF Passbook website

In the Passbook tab of the EPF Passbook website, you can see a summary of your contributions.

Check that this reflects your contributions and interest payments correctly. In my wife's

case, the contributions were as expected, but the interest for the previous year (2023) had not been

added yet. Fortunately, when she withdrew from the EPF, she received the interest for the previous year and the interest accumulated thus far in the current year. Following this, the passbook was updated to reflect

the interest payments.

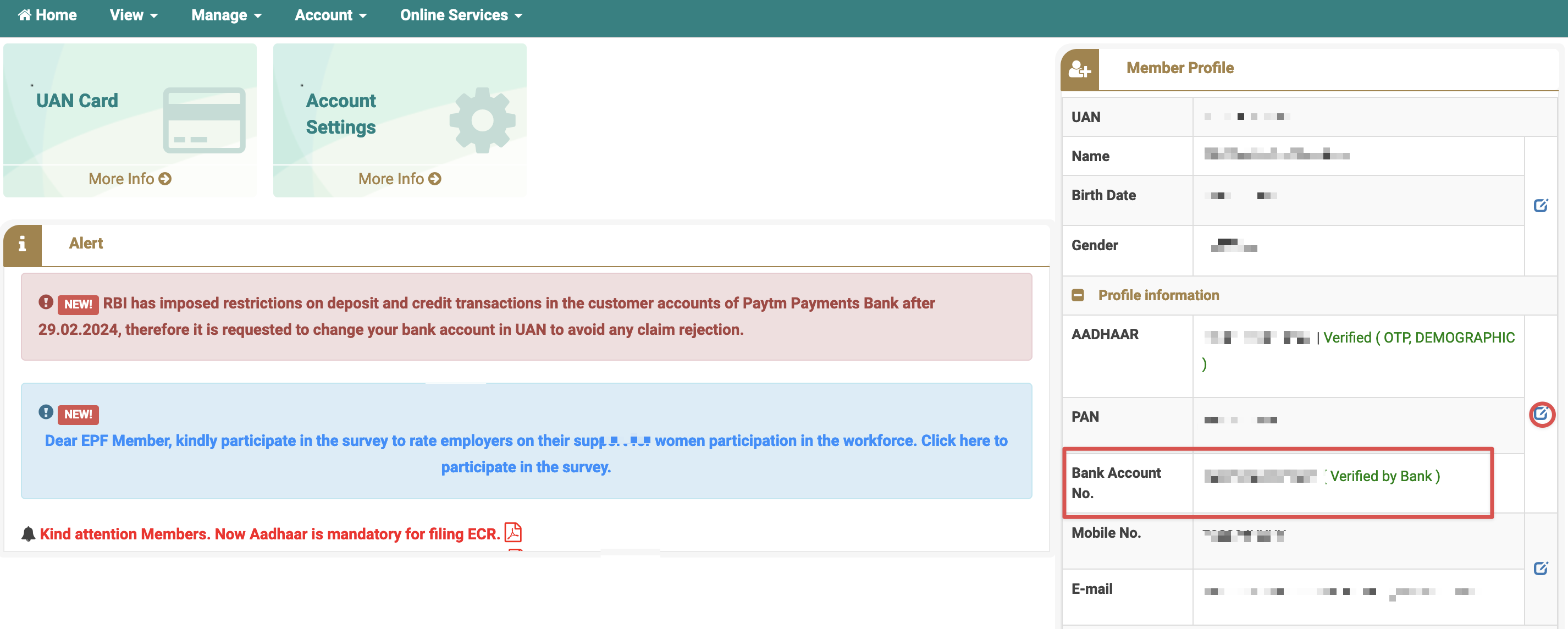

4. Log into the Unified Member Portal and check the linked bank account

Log into the Unified Member Portal. I recommend using the Firefox browser for this. This website is even worse than the EPF Passbook website. It sometimes logs you out immediately after you log in! We must have logged in a hundred times before we finally managed to submit the claim.

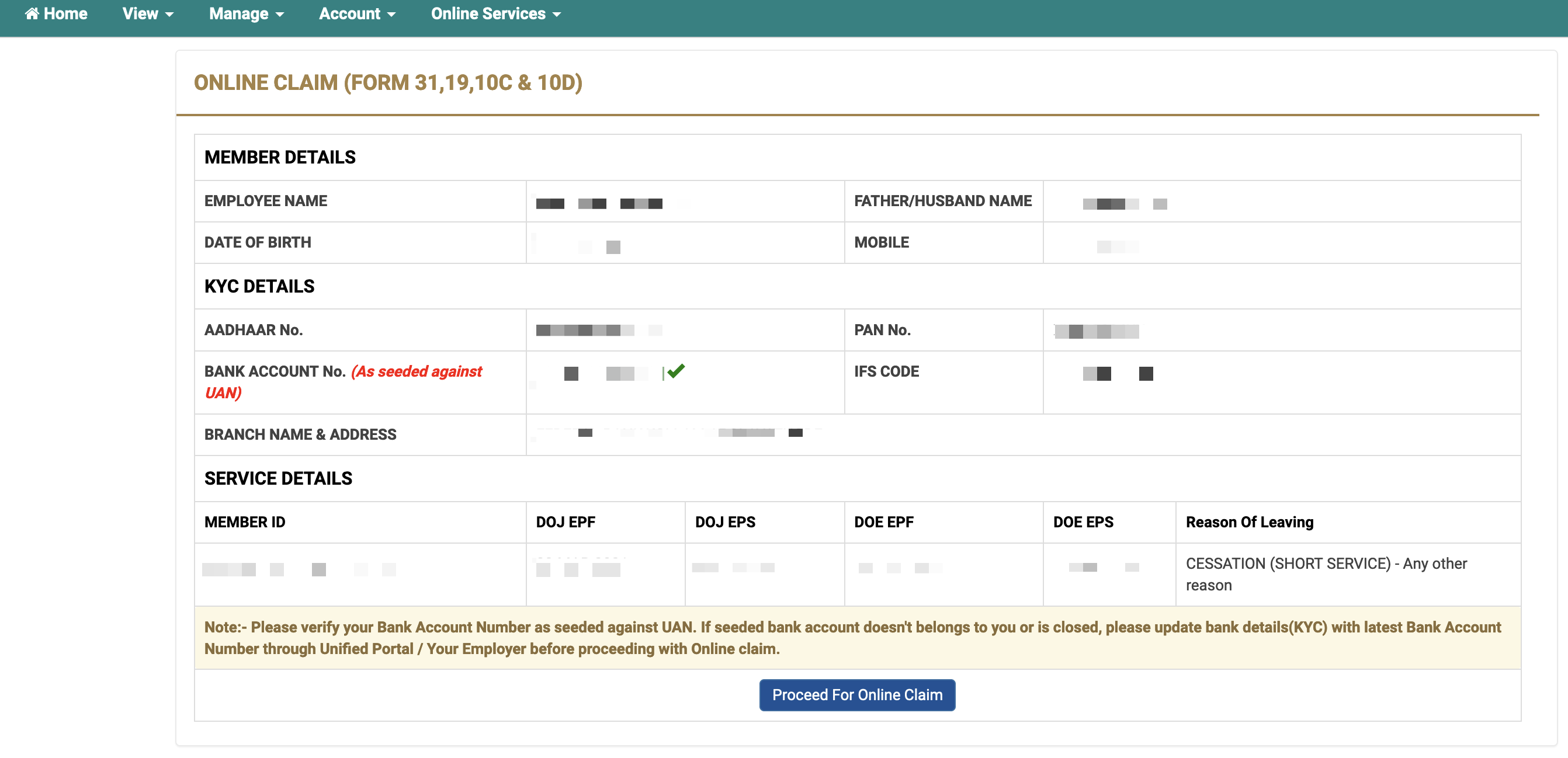

As shown in the image below, you can check the bank account registered with the Unified Member Portal. This is the bank account that the EPF money will be transferred to on withdrawal.

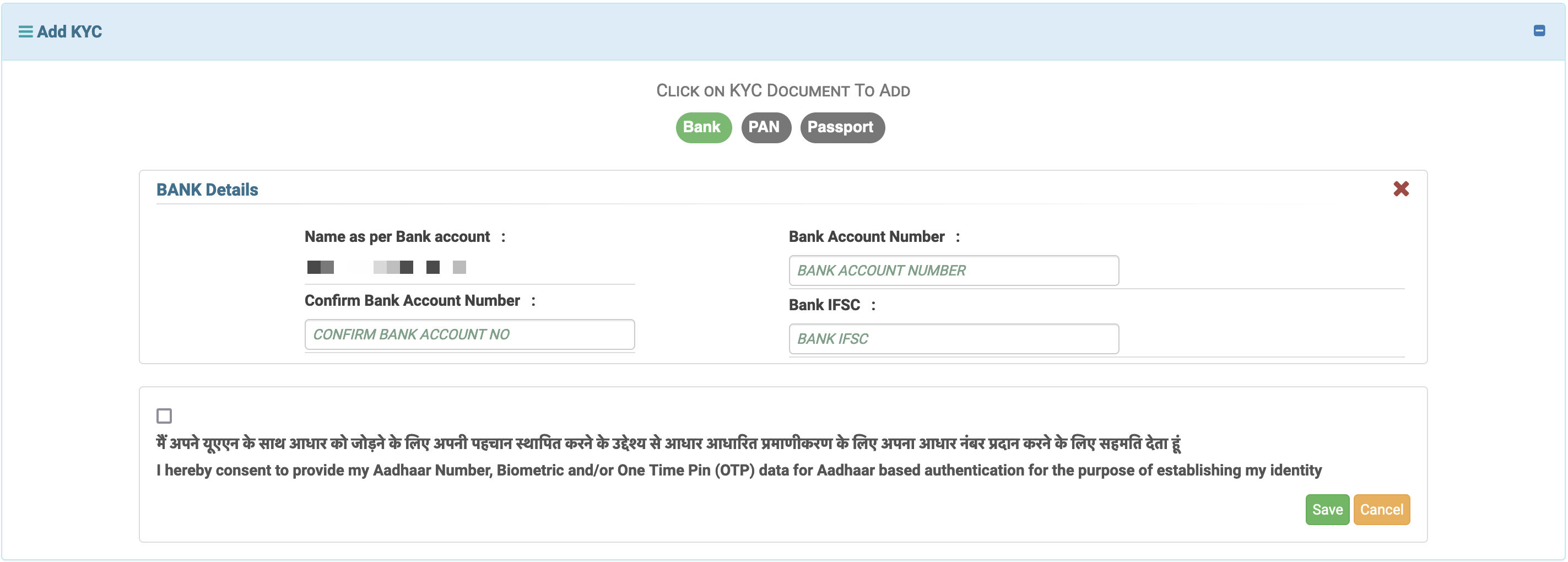

5. Update the linked bank account (if necessary)

If a bank account is not linked, or if you want to change the bank account, you can click on the edit button next to it and add a KYC document for your bank account. I don't recall how long it took to get verified, but it was not immediate.

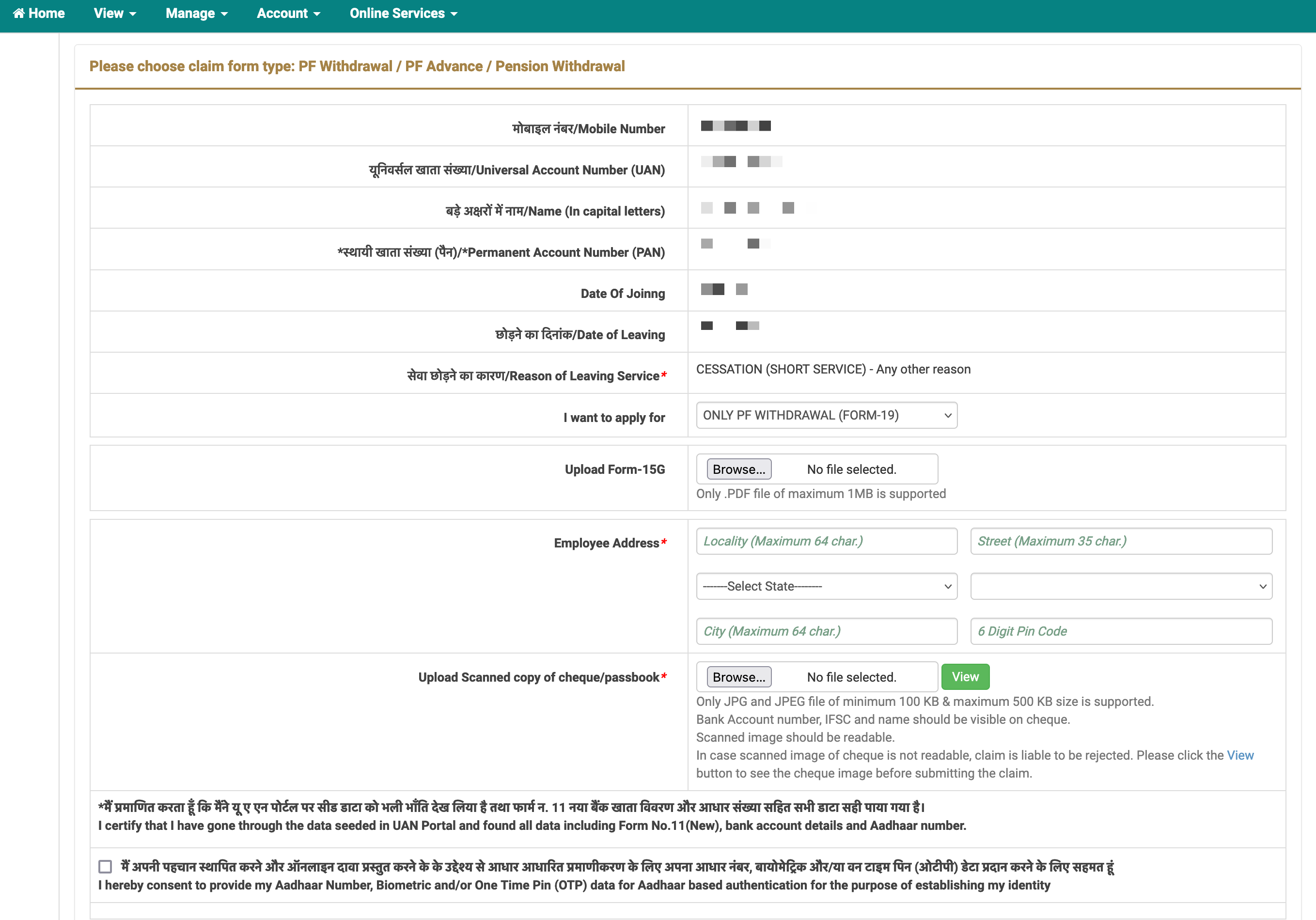

6. Submit a claim form

Navigate to the Online Services tab and click on the Claim menu. Proceed to fill out

the form and submit it. For the Reason of Leaving, we did not have the option of

selecting any other reason than CESSATION (SHORT SERVICE).

You can check your claim status under the Online Services > Track Claim Status.

7. You will get an SMS when the claim is settled

We got an SMS when the claim was settled about 2.5 weeks after submitting the claim. The SMS looks like:

Your Online Claim Form-19 ( XXXXXXXXXXXXXXXX ) is Settled for Rs. 1234/- on 12-09-24 and will be credited within 3 working days in bank A/c ending with 1234.

8. Receive the money in your bank account

In our case it took 11 days, slightly longer than the 3 working days the SMS had indicated

Conclusion

The process of withdrawing the EPF as an NRI was not as straightforward as we had hoped, but we're glad it's behind us now. The process may differ slightly for you depending on your circumstances, but I hope this guide helps.

Feel free to leave any feedback or questions in the comments section.